All Categories

Featured

Table of Contents

- – Premium Accredited Investor Investment Returns...

- – Leading Accredited Investor Investment Opportu...

- – Next-Level Accredited Investor Property Inves...

- – High-End Accredited Investor Investment Funds

- – High-Performance High Yield Investment Oppor...

- – High-Performance Accredited Investor Opportu...

- – First-Class Accredited Investor Passive Inco...

The guidelines for recognized capitalists vary among jurisdictions. In the U.S, the interpretation of an approved capitalist is presented by the SEC in Guideline 501 of Law D. To be a certified financier, a person must have a yearly revenue surpassing $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of gaining the exact same or a greater revenue in the existing year.

This amount can not include a main residence., executive police officers, or supervisors of a company that is issuing unregistered securities.

Premium Accredited Investor Investment Returns for Wealth-Building Solutions

If an entity is composed of equity owners who are certified investors, the entity itself is an accredited capitalist. A company can not be developed with the single function of buying specific protections. An individual can qualify as an accredited capitalist by demonstrating enough education and learning or task experience in the economic industry

People that wish to be certified investors don't apply to the SEC for the designation. Instead, it is the obligation of the company supplying a personal placement to see to it that every one of those approached are accredited financiers. Individuals or celebrations who want to be accredited capitalists can come close to the company of the unregistered safety and securities.

Mean there is a specific whose income was $150,000 for the last three years. They reported a main residence value of $1 million (with a home loan of $200,000), a car worth $100,000 (with an impressive funding of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Net worth is determined as assets minus liabilities. This individual's internet worth is precisely $1 million. This entails a calculation of their properties (besides their key residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto finance equaling $50,000. Because they fulfill the total assets demand, they certify to be an accredited financier.

Leading Accredited Investor Investment Opportunities

There are a couple of much less usual qualifications, such as handling a count on with greater than $5 million in possessions. Under federal securities regulations, only those that are recognized investors might get involved in specific safeties offerings. These may consist of shares in exclusive placements, structured items, and exclusive equity or hedge funds, to name a few.

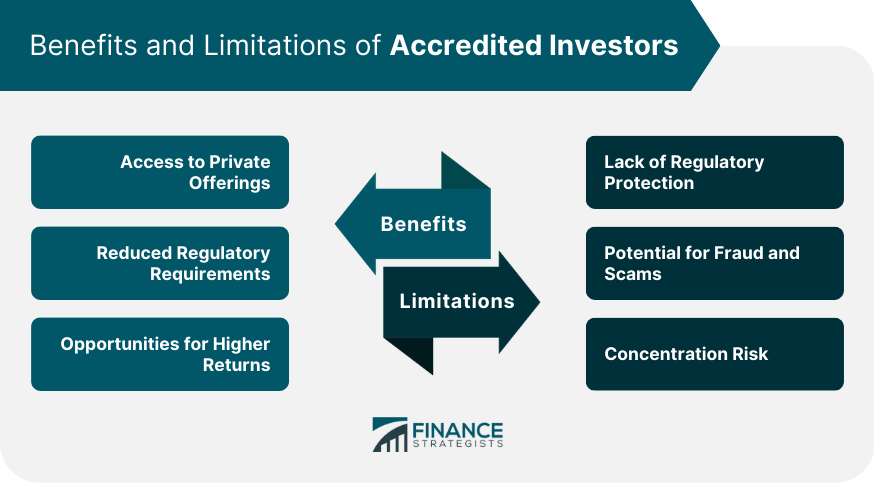

The regulators wish to be particular that participants in these highly risky and intricate financial investments can fend for themselves and judge the risks in the absence of government security. The recognized capitalist rules are developed to safeguard potential financiers with limited monetary expertise from risky endeavors and losses they may be unwell equipped to hold up against.

Accredited capitalists fulfill credentials and professional standards to gain access to exclusive financial investment possibilities. Designated by the U.S. Stocks and Exchange Compensation (SEC), they obtain entrance to high-return choices such as hedge funds, endeavor funding, and exclusive equity. These financial investments bypass full SEC enrollment but bring greater dangers. Recognized financiers need to meet revenue and total assets requirements, unlike non-accredited people, and can spend without limitations.

Next-Level Accredited Investor Property Investment Deals

Some vital modifications made in 2020 by the SEC include:. This change acknowledges that these entity types are usually utilized for making investments.

These amendments increase the accredited capitalist pool by around 64 million Americans. This larger access gives a lot more opportunities for financiers, but additionally increases prospective risks as less financially advanced, capitalists can take part.

These investment choices are special to recognized capitalists and institutions that certify as a recognized, per SEC policies. This offers recognized investors the chance to spend in arising business at a phase before they think about going public.

High-End Accredited Investor Investment Funds

They are checked out as financial investments and are easily accessible only, to certified customers. In enhancement to recognized companies, certified financiers can select to buy startups and promising ventures. This uses them tax obligation returns and the chance to get in at an earlier phase and potentially enjoy incentives if the firm thrives.

Nonetheless, for investors open to the dangers included, backing startups can bring about gains. Much of today's tech business such as Facebook, Uber and Airbnb stemmed as early-stage startups supported by certified angel investors. Sophisticated investors have the possibility to discover investment alternatives that might yield more earnings than what public markets use

High-Performance High Yield Investment Opportunities For Accredited Investors with Maximum Gains

Although returns are not assured, diversity and portfolio enhancement options are expanded for financiers. By expanding their profiles through these broadened financial investment methods certified financiers can enhance their techniques and possibly achieve superior long-term returns with correct threat management. Skilled financiers commonly come across investment choices that might not be easily offered to the basic financier.

Investment alternatives and safeties supplied to accredited investors generally involve greater dangers. Personal equity, venture resources and bush funds often focus on spending in properties that bring threat but can be liquidated easily for the opportunity of better returns on those risky investments. Investigating before spending is important these in scenarios.

Lock up periods avoid capitalists from taking out funds for even more months and years on end. Investors might have a hard time to accurately value exclusive assets.

High-Performance Accredited Investor Opportunities with Maximum Gains

This modification might prolong certified investor condition to a variety of individuals. Permitting partners in fully commited relationships to incorporate their sources for shared eligibility as certified financiers.

Enabling people with particular professional accreditations, such as Series 7 or CFA, to certify as accredited capitalists. This would identify economic sophistication. Developing added requirements such as evidence of monetary proficiency or successfully finishing a certified capitalist exam. This can make certain capitalists comprehend the risks. Limiting or getting rid of the key home from the net well worth estimation to decrease possibly inflated evaluations of wealth.

On the various other hand, it can also result in skilled investors thinking extreme risks that might not be appropriate for them. Existing accredited capitalists might encounter raised competitors for the ideal financial investment opportunities if the swimming pool expands.

First-Class Accredited Investor Passive Income Programs

Those that are currently taken into consideration certified financiers have to remain upgraded on any modifications to the standards and policies. Their qualification could be subject to modifications in the future. To keep their standing as accredited capitalists under a revised interpretation adjustments may be necessary in wide range management tactics. Services seeking recognized capitalists ought to remain attentive regarding these updates to ensure they are bring in the best audience of investors.

Table of Contents

- – Premium Accredited Investor Investment Returns...

- – Leading Accredited Investor Investment Opportu...

- – Next-Level Accredited Investor Property Inves...

- – High-End Accredited Investor Investment Funds

- – High-Performance High Yield Investment Oppor...

- – High-Performance Accredited Investor Opportu...

- – First-Class Accredited Investor Passive Inco...

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Government Tax Lien Properties For Sale

How To Start Tax Lien Investing

More

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Government Tax Lien Properties For Sale

How To Start Tax Lien Investing