All Categories

Featured

Table of Contents

For instance, if the homeowner pays the rate of interest and penalties early, this will reduce your return on the financial investment. And if the homeowner declares bankruptcy, the tax obligation lien certificate will be subservient to the mortgage and government back tax obligations that are due, if any type of. An additional danger is that the value of the household building can be much less than the quantity of back taxes owed, in which instance the property owner will certainly have little incentive to pay them.

Tax lien certifications are usually sold using public auctions (either online or face to face) carried out every year by county or municipal taxing authorities. Offered tax obligation liens are normally published several weeks prior to the auction, in addition to minimum quote quantities. Examine the internet sites of counties where you're interested in buying tax obligation liens or call the region recorder's office for a listing of tax obligation lien certifications to be auctioned.

Tax Lien Investing Pros And Cons

Remember that a lot of tax obligation liens have an expiry date after which time your lienholder civil liberties end, so you'll need to move swiftly to raise your chances of maximizing your investment return. investing in tax lien certificate. Tax obligation lien investing can be a profitable way to invest in genuine estate, yet success requires detailed research study and due diligence

Firstrust has greater than a years of experience in providing funding for tax lien investing, together with a specialized team of licensed tax obligation lien specialists that can assist you take advantage of prospective tax lien spending possibilities. Please contact us to find out more about tax obligation lien investing. FEET - 643 - 20230118.

The tax lien sale is the last step in the treasurer's efforts to collect tax obligations on actual property. A tax obligation lien is positioned on every area home owing taxes on January 1 yearly and continues to be up until the real estate tax are paid. If the homeowner does not pay the residential or commercial property taxes by late October, the area markets the tax obligation lien at the annual tax obligation lien sale.

The capitalist that holds the lien will certainly be alerted every August of any kind of overdue tax obligations and can recommend those taxes to their existing lien. The tax obligation lien sale allows straining authorities to get their budgeted income without needing to wait on overdue taxes to be accumulated. It also supplies a financial investment possibility for the basic public, participants of which can buy tax lien certificates that can potentially gain an eye-catching rate of interest.

When retrieving a tax obligation lien, the property owner pays the the overdue taxes along with the overdue interest that has built up against the lien given that it was cost tax obligation sale, this is attributed to the tax obligation lien holder. Please speak to the Jefferson Area Treasurer 303-271-8330 to acquire benefit info.

Investing In Tax Lien

Building becomes tax-defaulted land if the real estate tax remain unpaid at 12:01 a.m. on July 1st. Residential or commercial property that has actually become tax-defaulted after five years (or 3 years when it comes to building that is additionally based on a problem reduction lien) becomes based on the county tax enthusiast's power to sell in order to satisfy the defaulted property taxes.

The area tax obligation collector may provide the home to buy at public auction, a sealed quote sale, or a discussed sale to a public company or certified not-for-profit company. Public auctions are the most common way of selling tax-defaulted home. The auction is carried out by the region tax obligation enthusiast, and the residential or commercial property is offered to the greatest prospective buyer.

Key Takeaways Navigating the world of genuine estate investment can be complicated, however understanding various financial investment opportunities, like, is well worth the work. If you're aiming to diversify your portfolio, buying tax liens may be an option worth discovering. This overview is created to assist you comprehend the essentials of the tax lien investment strategy, guiding you via its process and aiding you make educated decisions.

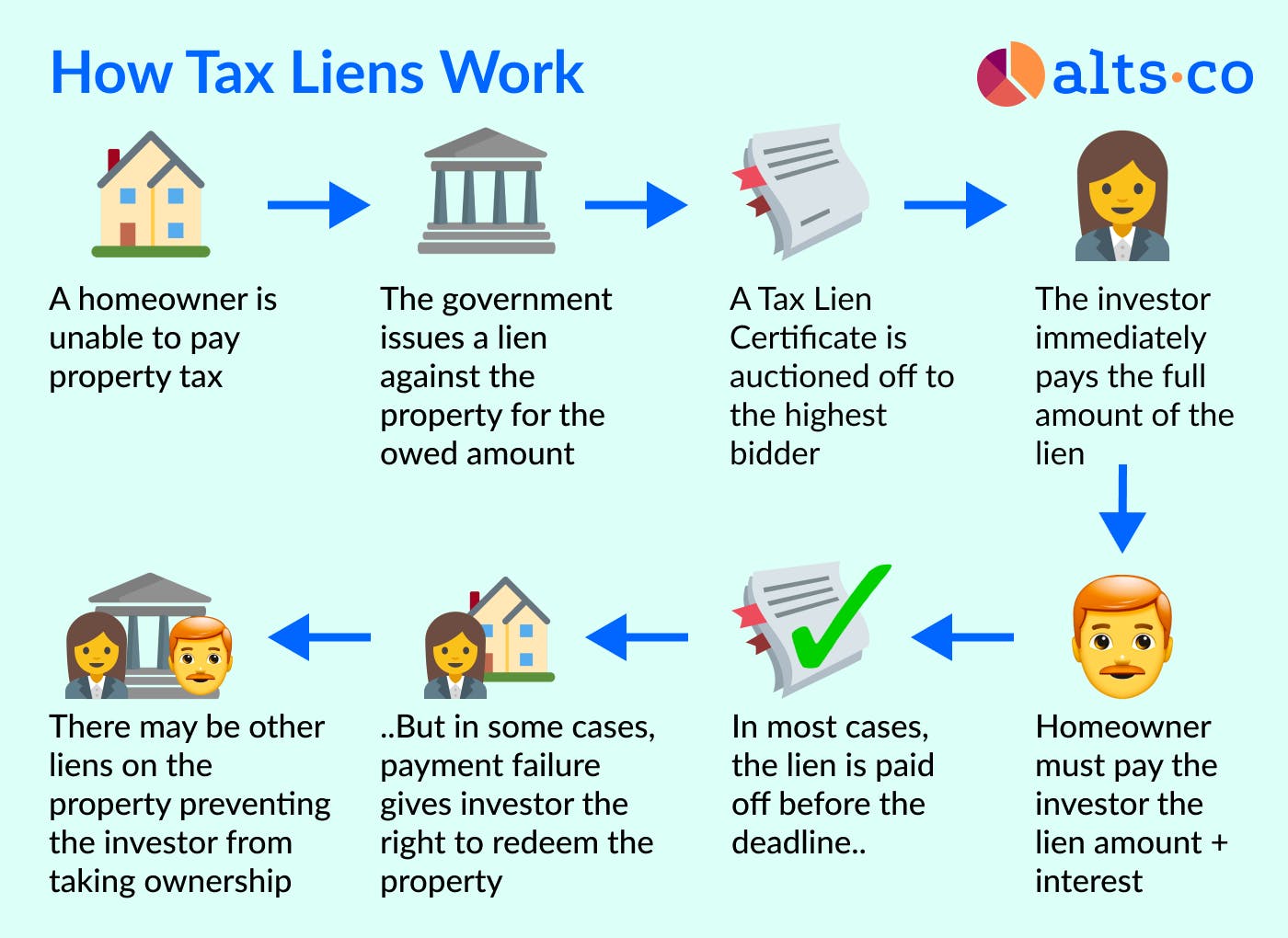

A tax obligation lien is a legal claim imposed by a government entity on a home when the owner stops working to pay residential property taxes. It's a way for the federal government to guarantee that it gathers the needed tax revenue. Tax liens are affixed to the home, not the individual, meaning the lien sticks with the residential property no matter ownership modifications till the financial obligation is cleared.

How Does Tax Lien Investing Work

] Tax lien investing is a kind of actual estate investment that includes purchasing these liens from the federal government. When you invest in a tax lien, you're essentially paying another person's tax obligation financial debt. In return, you obtain the right to collect the financial debt, plus interest, from the homeowner. If the proprietor fails to pay within a specified duration, you could even have the possibility to confiscate on the residential property.

As a capitalist, you can purchase these liens, paying the owed taxes. In return, you receive the right to accumulate the tax obligation debt plus passion from the residential or commercial property proprietor.

It's important to very carefully weigh these prior to diving in. Tax obligation lien certificate investing offers a much lower funding requirement when compared to various other forms of investingit's possible to delve into this property course for as low as a pair hundred dollars. Among the most substantial attracts of tax lien investing is the possibility for high returns.

In many cases, if the residential property owner fails to pay the tax financial obligation, the capitalist may have the opportunity to seize on the residential property. This can possibly lead to obtaining a residential or commercial property at a portion of its market price. A tax lien typically takes concern over other liens or home mortgages.

Tax lien spending includes browsing legal procedures, specifically if foreclosure comes to be required. Redemption Durations: Residential property proprietors typically have a redemption duration throughout which they can pay off the tax financial debt and interest.

Affordable Public auctions: Tax obligation lien auctions can be highly affordable, particularly for properties in desirable places. This competition can drive up costs and potentially minimize general returns.

Tax Lien Investing Scams

While these procedures are not complicated, they can be shocking to brand-new capitalists. If you are interested in getting going, assess the complying with steps to acquiring tax obligation liens: Beginning by enlightening yourself concerning tax obligation liens and exactly how realty auctions function. Recognizing the lawful and economic intricacies of tax obligation lien investing is vital for success.

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Government Tax Lien Properties For Sale

How To Start Tax Lien Investing